Introduction

History

The firm was established on September 1, 81, the Republic of China, affiliation National Taxation Bureau of the Central Area, Ministry of Finance, National Taxation of the two administrative districts of Zhushan Town and Lugu Township, Nantou County, the area of the jurisdiction is about 389 square kilometers, and it is located in a remote mountainous area, the population is nearly 67,000. It is a typical agricultural township.

The office was originally co-located with the Zhushan Branch of the Nantou County Government Taxation Bureau, due to the collapse of the office building of the Great Earthquake on September 21, 1988 (September 21), own office building was completed and opened at the end of 1994, it is also the first unit to have its own self-built office building, the high-quality environment and perfect service measures have been highly recognized by the public.

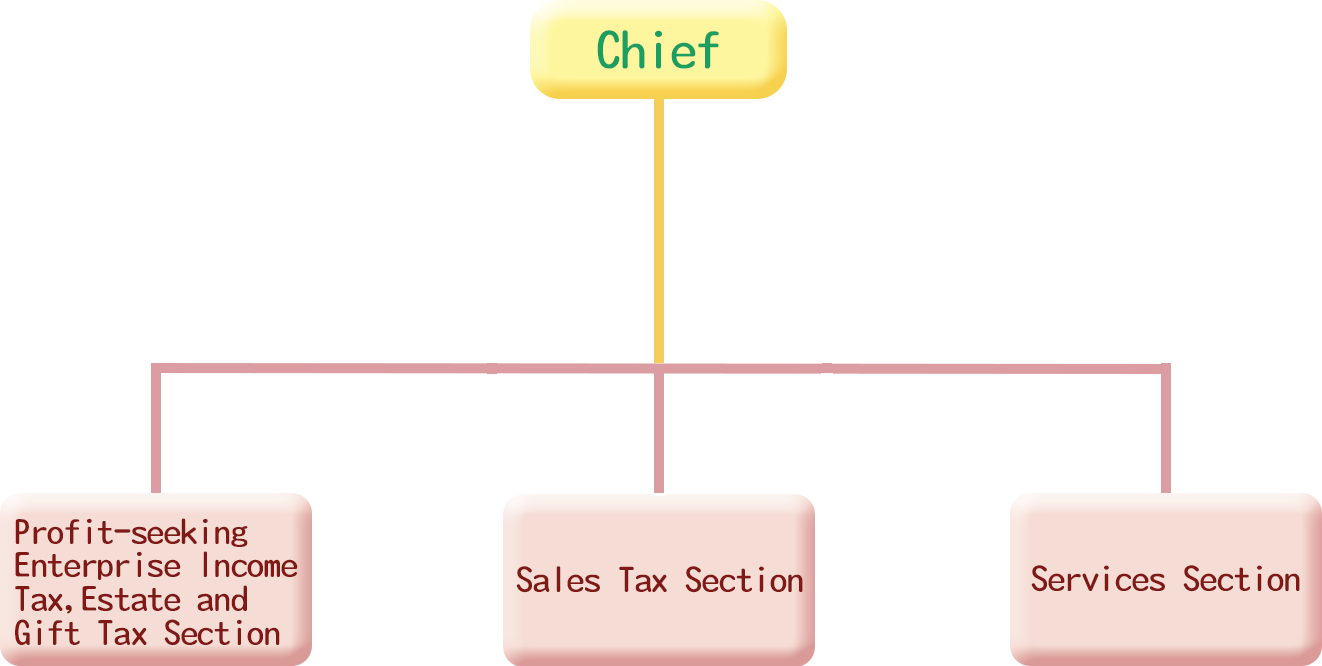

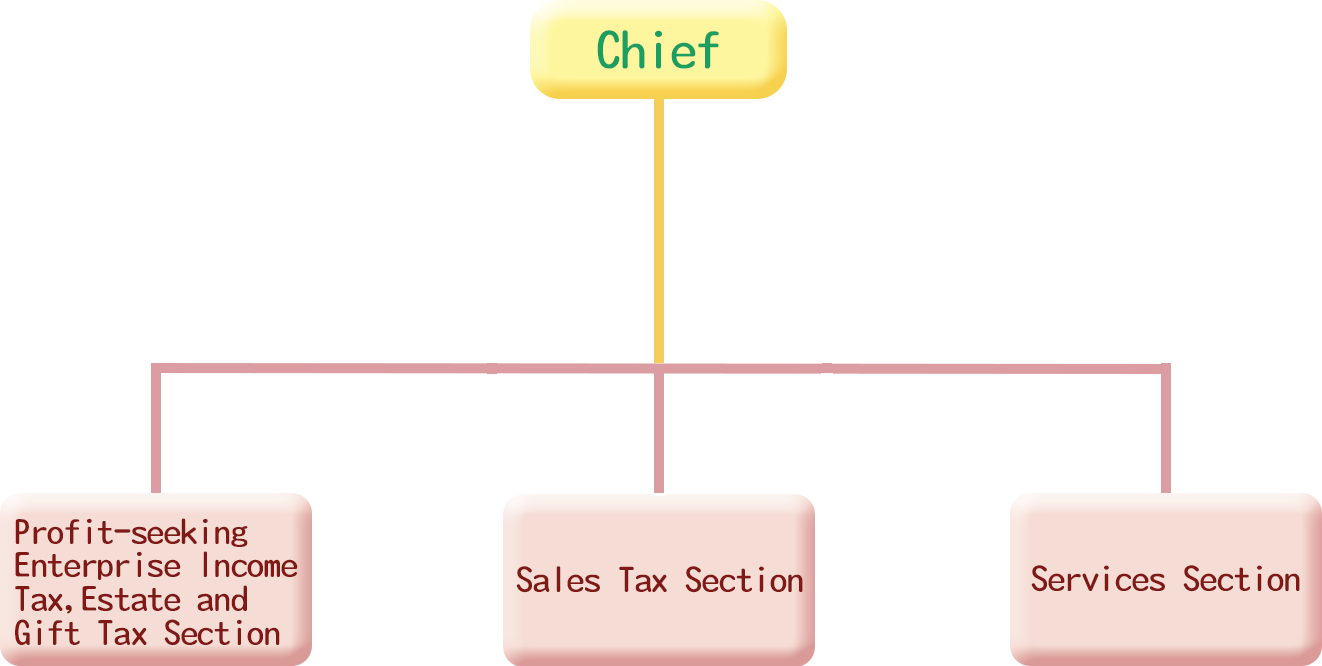

Organization Structure

Responsibilities

| Profit-seeking Enterprise Income Tax, Estate and Gift Tax Section |

Services Section |

- Tax return applications for profit-seeking Enterprise Income Tax and the related review, auditing, collection, form issuance and license collection

- Review and punishment of simple cases on the violation of regulations concerning profit-seeking enterprise income tax

- Tax return applications for Estate Tax and Gift Tax and the related review, auditing, collection, form issuance and license collection

- Collection of Securities Transaction Tax and Futures Transaction Tax

- Planning of management and evaluation operations

- Management of tax related matters

- Management of tax planning and rebates/returns

- Documentation of official documents, management of archives, general affairs and cashier

|

- Tax return applications for Individual Income Tax and the related review, auditing, collection, form issuance and license collection

- Tax return applications for foreign taxpayers individual income tax and the related reviews, auditing, collection, form issuance and license collection

- Review and punishment of simple cases on the violation of regulations concerning Individual Income Tax

- Data collection, entry and management of information of Individual Income Tax

- Survey and assessment of Income from Professional Practice and declaration of witholding and non-withholding tax statement

- Tax return applications for House and Land Transactions Income Tax and the related review, auditing, collection, form issuance and license collection

- Tax payment services

- Tax education and promotion

- Computer equipment management, log-in station operation

- General service counter

|

| Sales Tax Section |

|

- Tax return applications for Business Tax(including media applications) and the related review, auditing, collection, form issuance and license collection

- Review and punishment of simple cases on the violation of regulations concerning Business Tax

- Investigation of reported cases that violate the regulations on Business Tax

- Management of registration of Business Tax

- Management of uniform invoice

- Tax return applications for Commodity Tax, Tobacco and Alcohol Tax, and Specifically Selected Goods and Services Tax

|

|

Last updated:2024-11-20