Introduction

History

Our office was founded at 3~4F.,No.141 Jianzhong St.,East Dist.,Taichung City in September,1992. At first,we jointed Dajyh Branch,Local Tax Bureau of Taichung City Government to offer taxation services which having jurisdiction over East and South Districts in Taichung City.Due to revoking the impoistion of Business Tax, abruptly increasing workload was far beyond the office capacity . It was therefore moved to 6~7F.,No.78 Sec.2, Fusing Rd.,South Dist.,Taichung City in December 18,2006. For efficient utilization of the government's porperty and saving the rental expenditure, the office had been moved to 8~9F.,No.95,Minquan Rd.,West Dist.,Taichung City in November 13,2017 which offer the public spacious and comfortable environment.

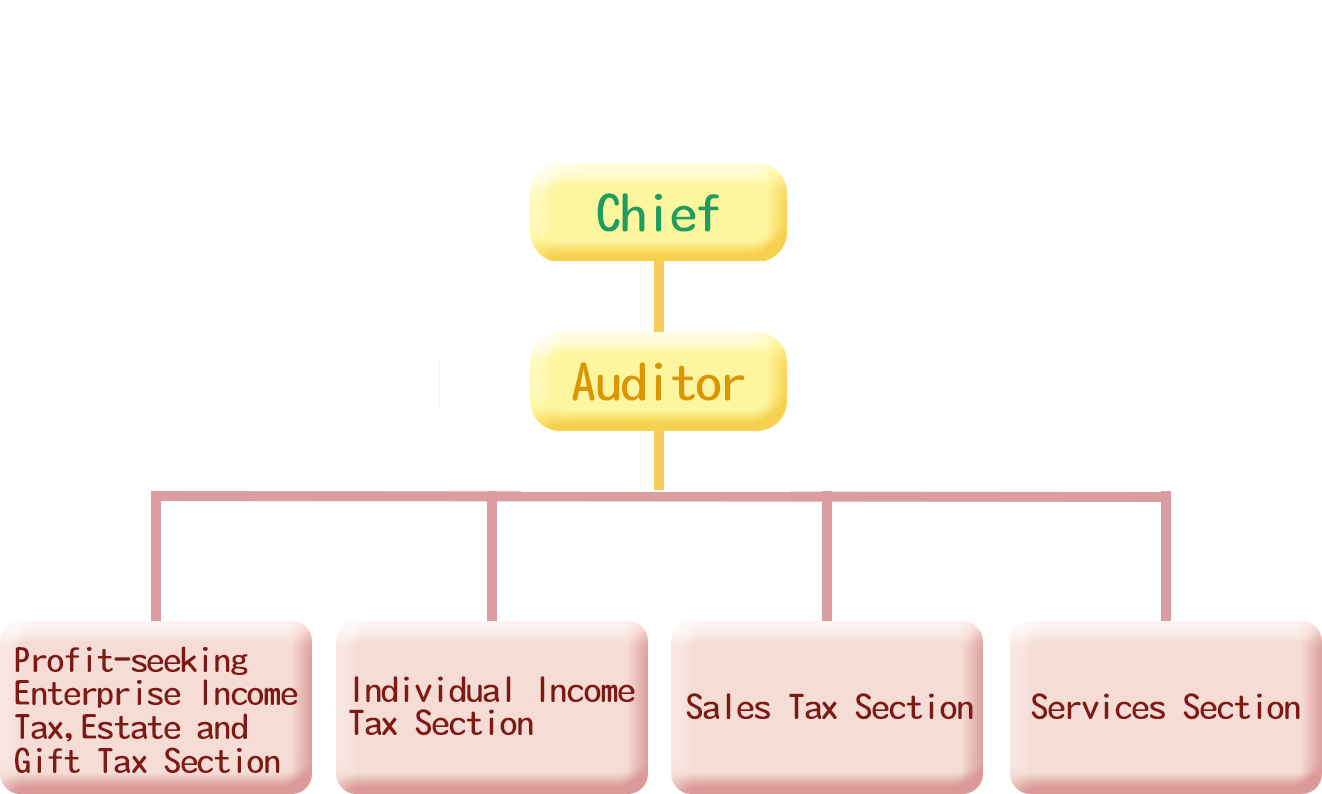

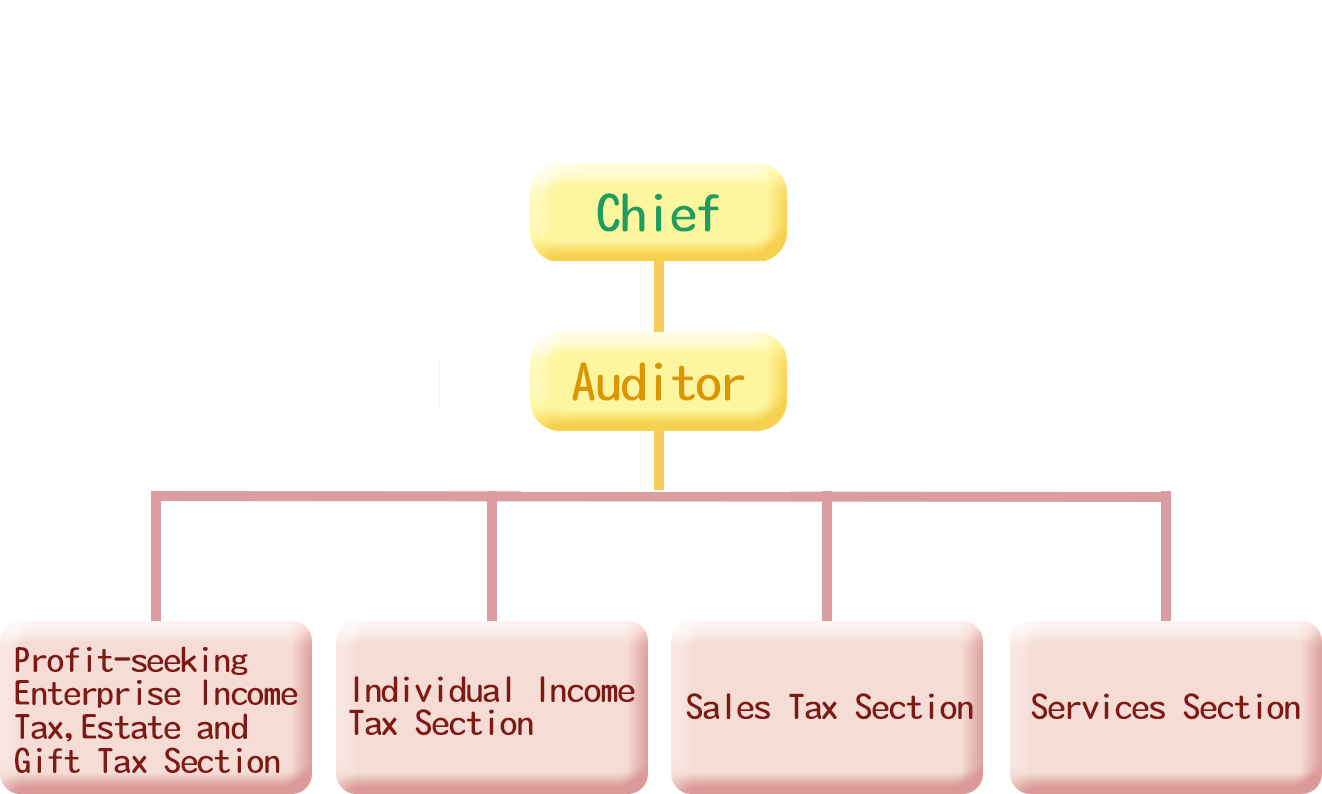

Organization Structure

Responsibilities

| Profit-seeking Enterprise Income Tax, Estate and Gift Tax Section |

Individual Income tax Section |

- Tax return applications for profit-seeking Enterprise Income Tax and the related review, auditing, collection, form issuance and license collection

- Review and punishment of simple cases on the violation of regulations concerning profit-seeking enterprise income tax

- Tax return applications for Estate Tax and Gift Tax and the related review, auditing, collection, form issuance and license collection

- Collection of Securities Transaction Tax and Futures Transaction Tax

|

- Tax return applications for Individual Income Tax and the related review, auditing, collection, form issuance and license collection

- Tax return applications for foreign taxpayers individual income tax and the related reviews, auditing, collection, form issuance and license collection

- Review and punishment of simple cases on the violation of regulations concerning Individual Income Tax

- Data collection, entry and management of information of Individual Income Tax

- Survey and assessment of Income from Professional Practice and declaration of witholding and non-withholding tax statement

- Tax return applications for House and Land Transactions Income Tax and the related review, auditing, collection, form issuance and license collection

|

| Sales Tax Section |

Services Section |

- Tax return applications for Business Tax(including media applications) and the related review, auditing, collection, form issuance and license collection

- Review and punishment of simple cases on the violation of regulations concerning Business Tax

- Investigation of reported cases that violate the regulations on Business Tax

- Management of registration of Business Tax

- Management of uniform invoice

- Tax return applications for Commodity Tax, Tobacco and Alcohol Tax, and Specifically Selected Goods and Services Tax

|

- Tax payment services

- Tax education and promotion

- Planning of management and evaluation operations

- Management of tax related matters

- Management of tax planning and rebates/returns

- Documentation of official documents, mail room, management of archives, general affairs and cashier

- Computer equipment management, log-in station operation and printing operation

- General service counter

|

Last updated:2022-06-30