Introduction

History

Established and named as“ Changhua County Branch, National Tax Administration of Central Taiwan Province, Ministry of Finance”in September 1992.

In January 2003, the business tax was self-collected, and in June of the same year, Changhua County Branch was relocated to current location as a joint office with the Local Tax Bureau, Changhua County.

Went through Reinvention of Tax Information System and renamed as “ Changhua Branch, National Taxation Bureau of the Central Area, Ministry of Finance” in January 2013.

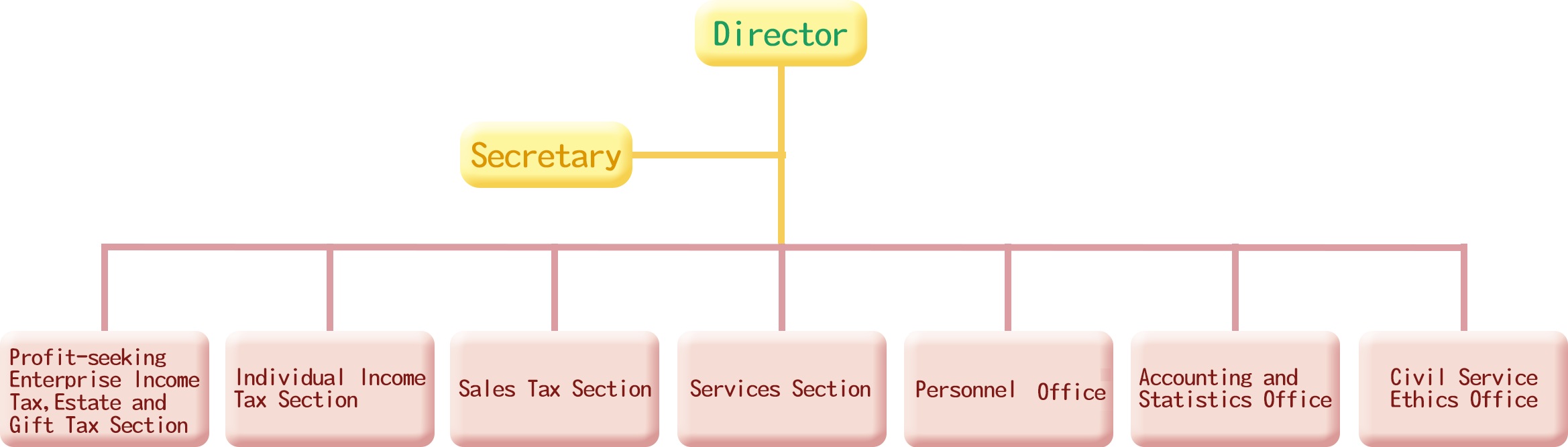

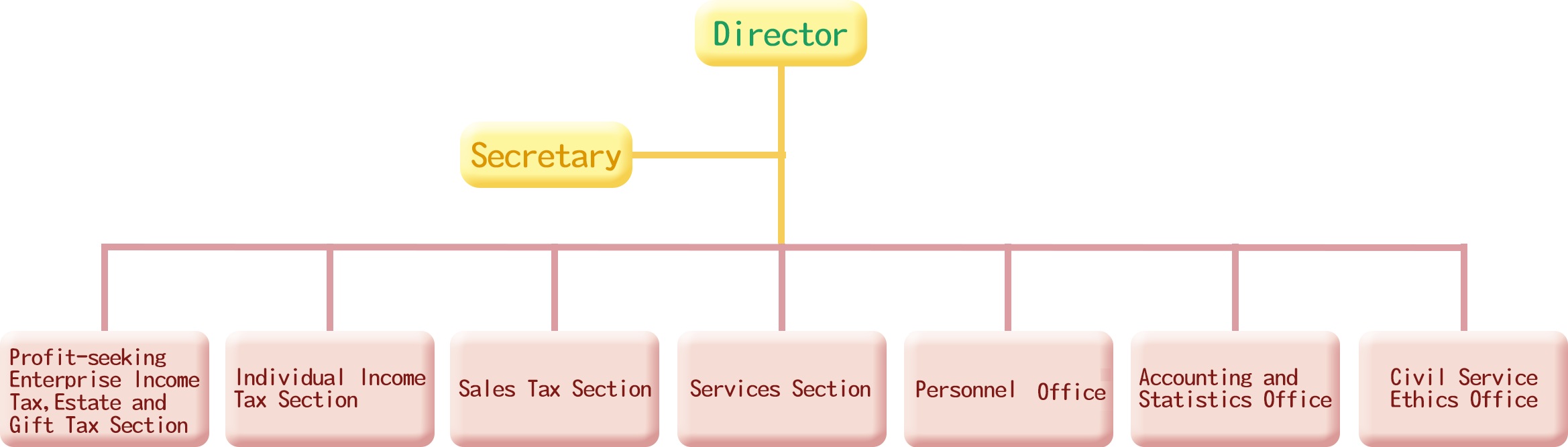

Organization Structure

Responsibilities

| Profit-seeking Enterprise Income Tax, Estate and Gift Tax Section |

Individual Income tax Section |

- Tax return applications for profit-seeking Enterprise Income Tax and the related review, auditing, collection, form issuance and license collection

- Review and punishment of simple cases on the violation of regulations concerning profit-seeking enterprise income tax

- Tax return applications for Estate Tax and Gift Tax and the related review, auditing, collection, form issuance and license collection

- Collection of Securities Transaction Tax and Futures Transaction Tax

|

- Tax return applications for Individual Income Tax and the related review, auditing, collection, form issuance and license collection

- Tax return applications for foreign taxpayers individual income tax and the related reviews, auditing, collection, form issuance and license collection

- Review and punishment of simple cases on the violation of regulations concerning Individual Income Tax

- Data collection, entry and management of information of Individual Income Tax

- Survey and assessment of Income from Professional Practice and declaration of witholding and non-withholding tax statement

- Tax return applications for House and Land Transactions Income Tax and the related review, auditing, collection, form issuance and license collection

|

| Sales Tax Section |

Services Section |

- Tax return applications for Business Tax(including media applications) and the related review, auditing, collection, form issuance and license collection

- Review and punishment of simple cases on the violation of regulations concerning Business Tax

- Investigation of reported cases that violate the regulations on Business Tax

- Management of registration of Business Tax

- Management of uniform invoice

- Tax return applications for Commodity Tax, Tobacco and Alcohol Tax, and Specifically Selected Goods and Services Tax

|

- Tax payment services

- Tax education and promotion

- Planning of management and evaluation operations

- Management of tax related matters

- Management of tax planning and rebates/returns

- Documentation of official documents, mail room, management of archives, general affairs and cashier

- Computer equipment management, log-in station operation and printing operation

- General service counter

|

| Personnel Office |

Accounting and Statistics Office |

Civil Service Ethics Office |

|

|

- General Budget

- Expenditure Accounting

- Tax Collection Accounting

- Statistics

|

- Civil Service Ethics operations

|

Last updated:2026-02-01