Introduction

History

Our branch was established on September 1, 1992. Originally, it was responsible for the national taxation of the northern, central, and western districts of Taichung City, as well as coordinated with the Local Tax Bureau of Taichung City. On January 1, 2005, our branch moved to the current location due to the westward relocation of the Taichung City Hall. Since that time, we have taken over the business of the Liming Tax Office, National Taxation Bureau. Now the service jurisdiction includes Xitun and Nantun District of Taichung City.

Our branch has been reorganized and renamed twice. First, on January 1, 2011, due to the merger of Taichung County and City, it was renamed from the "Taichung City Branch" to "Taichung Branch," National Taxation Bureau of the Central Area, Ministry of Finance, Taiwan Provincial Government. Second, on January 1, 2013, due to the reorganization of the Executive Yuan, the name was changed to "Taichung Branch of the Central Taxation Bureau of the Ministry of Finance." With our five leadership principles: service, professionalism, innovation, efficiency, and harmony, our branch has received multiple awards from the Executive Yuan including the Excellent English Living Environment in 2006, 2007 and 2011, the 6th Government Archives Management Gold File Award, and the 4th Government Service Quality Award.

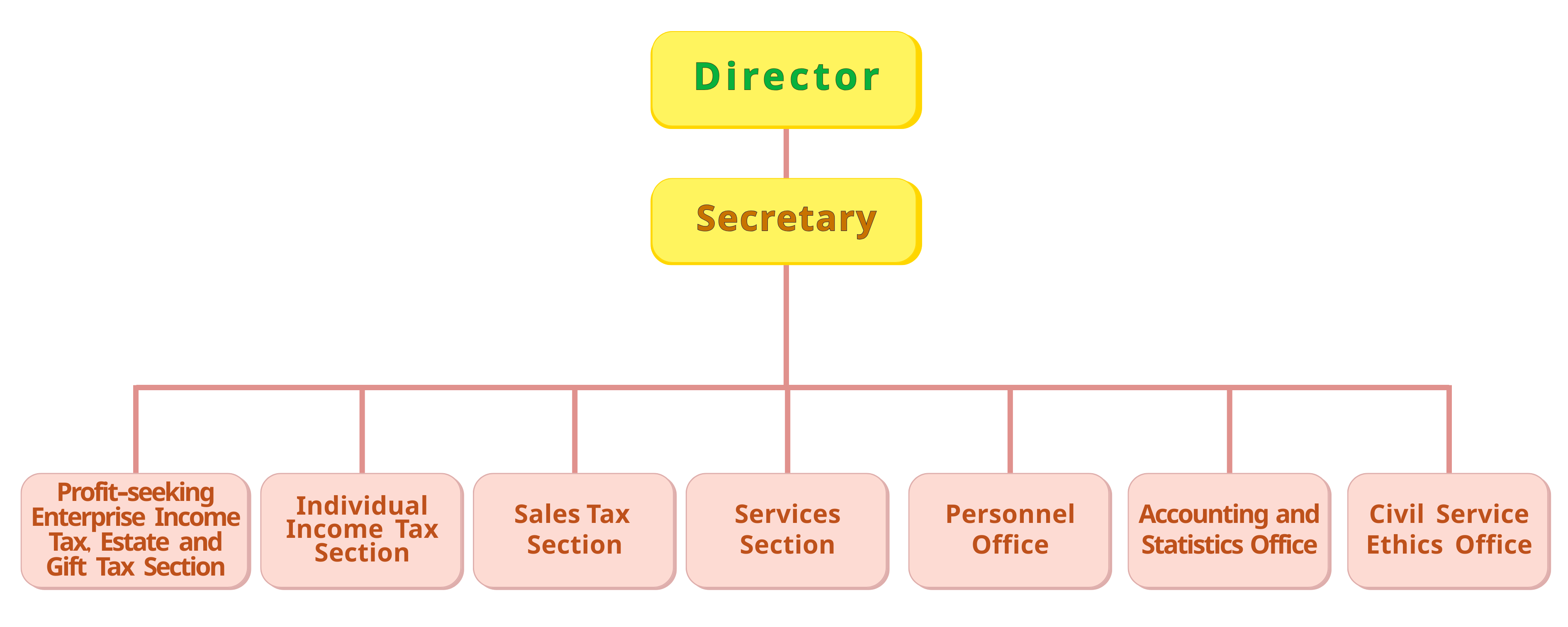

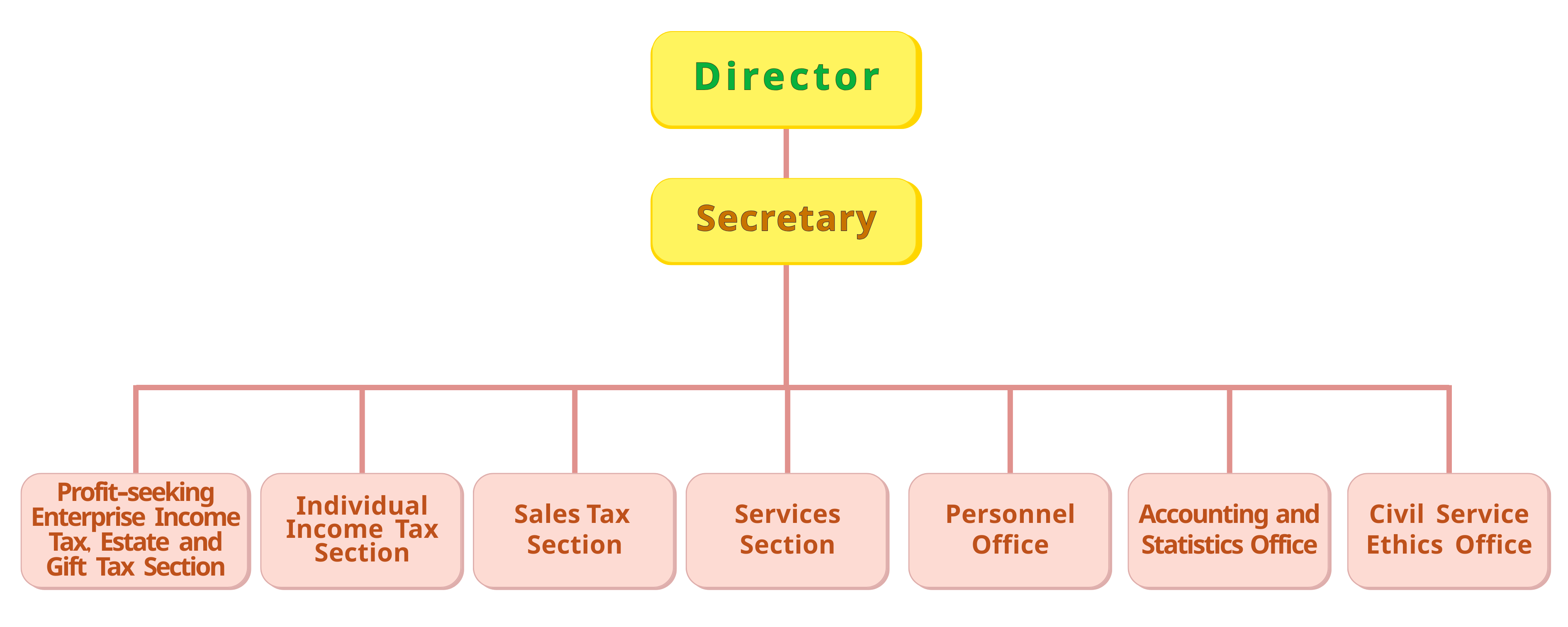

Organization Structure

Responsibilities

| Profit-seeking Enterprise Income Tax, Estate and Gift Tax Section |

Individual Income tax Section |

- Tax return applications for profit-seeking Enterprise Income Tax and the related review, auditing, collection, form issuance and license collection

- Review and punishment of simple cases on the violation of regulations concerning profit-seeking enterprise income tax

- Tax return applications for Estate Tax and Gift Tax and the related review, auditing, collection, form issuance and license collection

- Collection of Securities Transaction Tax and Futures Transaction Tax

|

- Tax return applications for Individual Income Tax and the related review, auditing, collection, form issuance and license collection

- Tax return applications for foreign taxpayers individual income tax and the related reviews, auditing, collection, form issuance and license collection

- Review and punishment of simple cases on the violation of regulations concerning Individual Income Tax

- Data collection, entry and management of information of Individual Income Tax

- Survey and assessment of Income from Professional Practice and declaration of witholding and non-withholding tax statement

- Tax return applications for House and Land Transactions Income Tax and the related review, auditing, collection, form issuance and license collection

|

| Sales Tax Section |

Services Section |

- Tax return applications for Business Tax(including media applications) and the related review, auditing, collection, form issuance and license collection

- Review and punishment of simple cases on the violation of regulations concerning Business Tax

- Investigation of reported cases that violate the regulations on Business Tax

- Management of registration of Business Tax

- Management of uniform invoice

- Tax return applications for Commodity Tax, Tobacco and Alcohol Tax, and Specifically Selected Goods and Services Tax

|

- Tax payment services

- Tax education and promotion

- Planning of management and evaluation operations

- Management of tax related matters

- Management of tax planning and rebates/returns

- Documentation of official documents, mail room, management of archives, general affairs and cashier

- Computer equipment management, log-in station operation and printing operation

- General service counter

|

| Personnel Office |

Accounting and Statistics Office |

Civil Service Ethics Office |

|

|

- General Budget

- Expenditure Accounting

- Tax Collection Accounting

- Statistics

|

- Civil Service Ethics operations

|

Last updated:2026-02-01