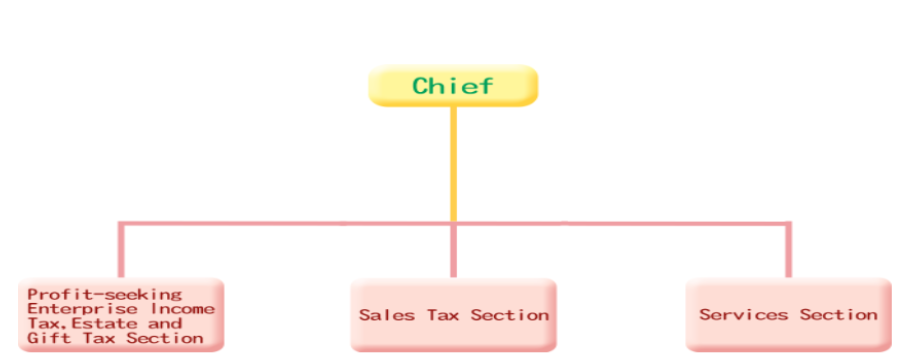

- Tax return applications for profit-seeking Enterprise Income Tax and the related review, auditing, collection, form issuance and license collection

- Review and punishment of simple cases on the violation of regulations concerning Profit-seeking enterprise income tax

- Tax return applications for Estate Tax and Gift Tax and the related review, auditing, collection, form issuance and license collection

- Collection of Securities Transaction Tax and Futures Transaction Tax

- General service counter

- Document Management

|

- Tax(Including Aliens) and the related review, auditing, collection, form issuance and license collection

- Review and punishment of simple cases on the violation of regulations concerning Individual Income Tax

- Data collection, entry and management of information of Individual Income Tax

- Survey and assessment of Income from Professional Practice and declaration of withholding and non-withholding tax statement

- Tax return applications for House and Land Transactions Income Tax and the related review, auditing, collection, form issuance and license collection

- Tax payment services

- Planning of management, evaluation operations , and management of archives

- Computer equipment management, log-in station operation

|

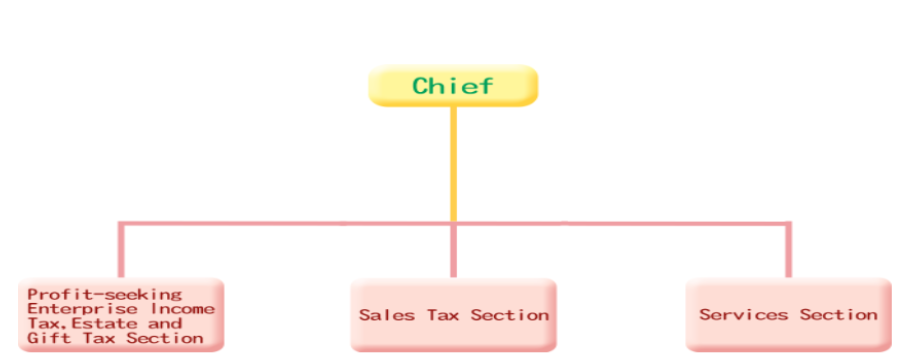

- Tax return applications for Business Tax(including media applications) and the related review, auditing, collection, form issuance and license collection

- Review and punishment of simple cases on the violation of regulations concerning Business Tax

- Investigation of reported cases that violate the regulations on Business Tax

- Management of registration of Business Tax

- Management of uniform invoice

- Tax return applications for Commodity Tax, Tobacco and Alcohol Tax, and Specifically Selected Goods and Services Tax

- Miscellaneous

- Tax education and promotion

- Management of tax related matters

|

|