History

Founded on September 1, 1981, the Dongshi office,National Taxation Bureau of the Central Area shared same working office with Taichung County Tax Collection Office of Dongshi Branch in early days. In 1998, due to insufficient office space, the Dongshi office was seperated from the Tax collection office and was relocated to No. 105, Fengshi Road, Yanping Lane, Dongshi District, Taichung City. Since the new office was located in the prime area of Dongshi District and the rental,as a consequence,was way above the average,the need for searching and building a new operating office for Dongshi office was put it on agenda.In 2008, Dongshi office was moved to No.1, Zhenger Street, Beixingli, Dongshi District, Taichung City (current location). The current site is the Dongshi Sub-office of the County Tax Collection Office and the temporary office of Dongshi Lands Office after the 921 earthquake. It will be retained after the new office for Dongshi office is completed.

The populations,in Dongshi office's jurisdiction area, is consisted mostly by farmers, and the people in this area have simple customs. Because the area is located between the Central Mountains and the Taichung Basin, affected by climate and terrain, it has abundant rainfall and a pleasant climate for high economic value fruit trees to thrive, fruits, such as High altitude Pear, Peach, Citrus, Sweet Persimmon and Grape, are massively cultivated. Since fruits can be seen as a unique kind of product in this area, Dongshi office's jurisdiction area is also known as the hometown of fruit.

Service Regions:

Dongshi District, Heping District, Sinshe District, Shigang District, Taichung City

Population:100,000人

Administration Area:1,172,800,919 square meters

Registered number of industrial and commercial households: Using Uniformed invoices: 2,137 households; Non-Using Uniformed invoices:2,212 households (Up until 2016.12.31)

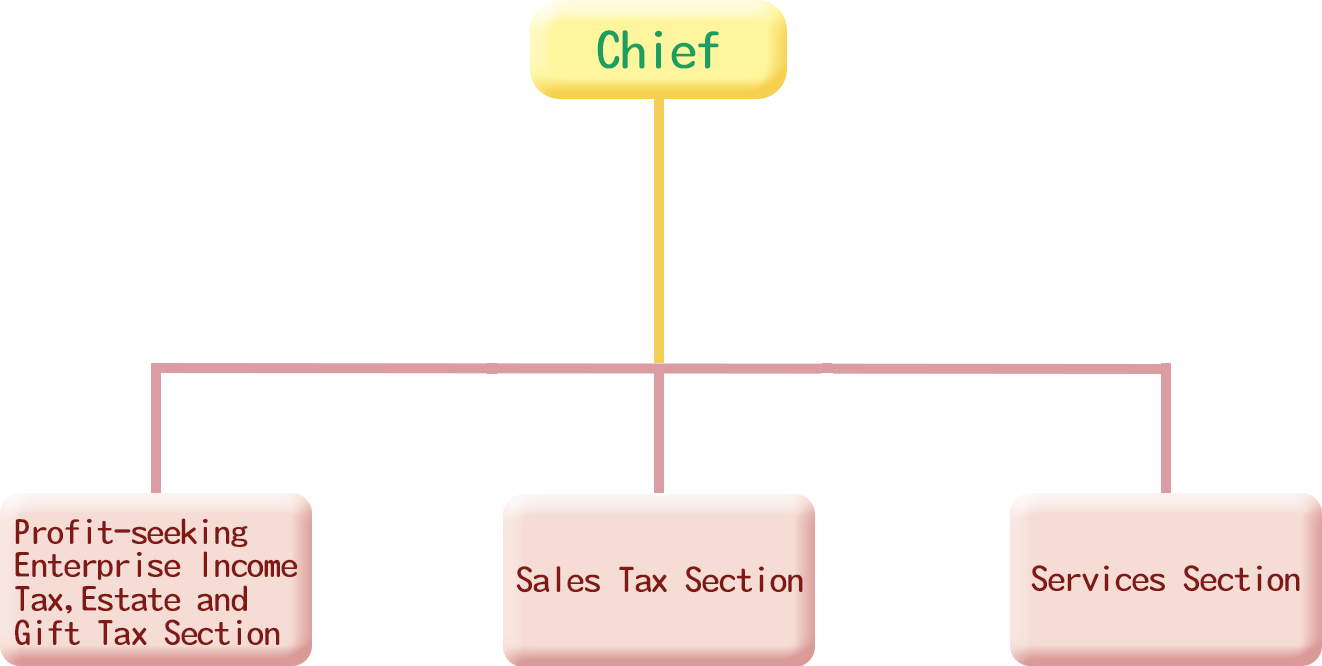

Organization Structure

Responsibilities

| Profit-seeking Enterprise Income Tax, Estate and Gift Tax Section | Services Section |

|

|

| Sales Tax Section | |

|